Question:

Which exchange has consistently used its own trading profits to buy and burn $LUNC almost every month for the past 4 years?

Answer: Binance.

Burning - Not via an on-chain tax.

Burning - Not by taxing users.

Burning - Using profits.

There was a short pause when the community voted to redirect part of the burn into developer minting, a decision that didn’t age well given LUNC’s ~6.46T supply, but that’s history now.

The key takeaway matters more than the past:

Buy-and-burn from profits is NOT burn via taxation.

They are fundamentally different mechanisms.

Binance’s dominance isn’t just scale, it’s strategy. And the numbers back it up.

Lesson for LUNC & $USTC:

You cannot tax your way out of a multi-trillion oversupply or unresolved debt problem.

Sustainable reduction comes from productive systems that generate yield, then use that yield to burn supply.

That’s exactly the same logic behind the Ceramic USTC Vampire Repeg of Value

USTC goes in → gets locked → buys yield → gets processed → becomes #USTR → can later become #UST1.

Apply the same principle to LUNC, lock supply, deploy it productively, and use the yield to buy and burn, and you move from taxation to economics.

The best in the business already showed the way. 😎

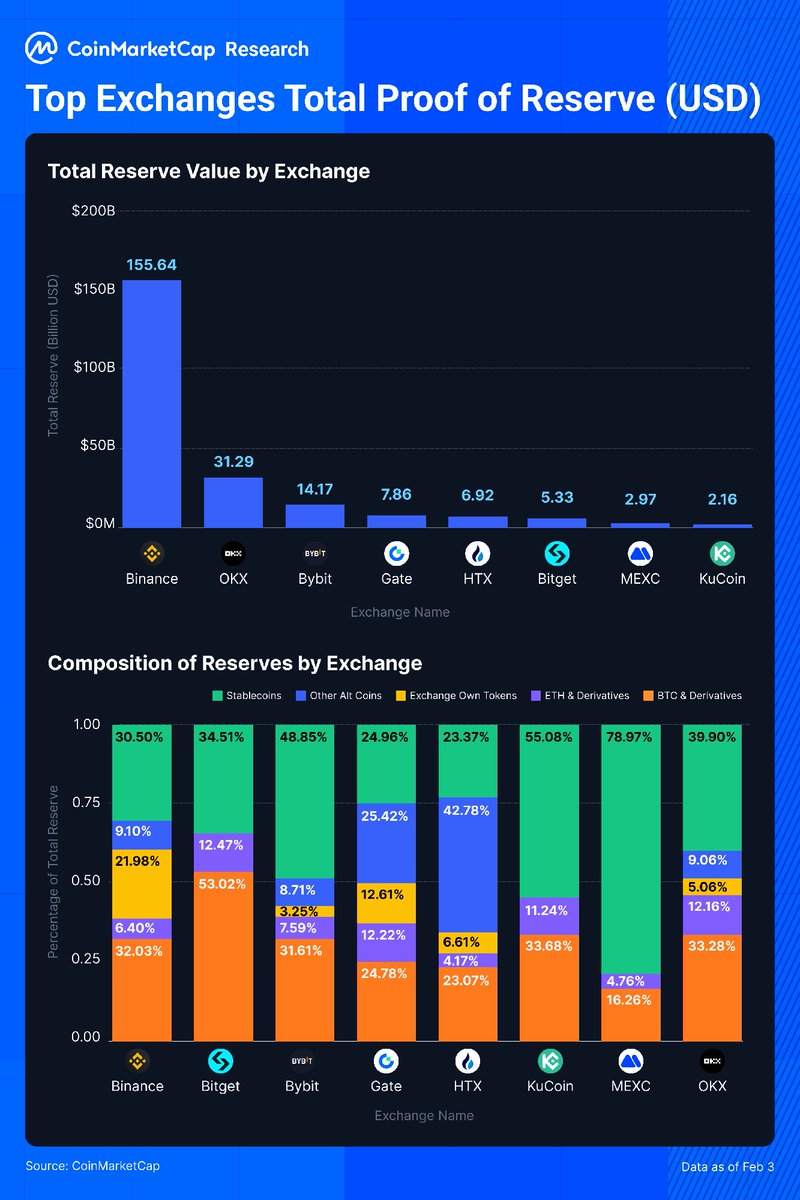

📊 New data drop: Proof of Reserve analysis across top exchanges reveals massive scale differences, distinct asset strategies, and where liquidity really sits.

Binance's dominance is striking, but the compositional differences tell an even more interesting story 👇

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research