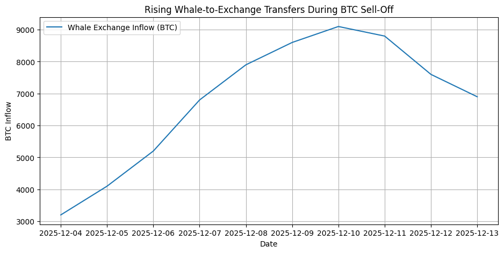

$BTC’s drop to the $85K region has put the spotlight firmly on whale behavior, and the data shows clear distribution into strength before this move. Large holders took advantage of the post-FOMC liquidity to offload positions, triggering cascading sell pressure as leverage unwound. This kind of move is typical after macro-driven pumps, where smart money sells first and lets volatility do the rest.

$BTC’s drop to the $85K region has put the spotlight firmly on whale behavior, and the data shows clear distribution into strength before this move. Large holders took advantage of the post-FOMC liquidity to offload positions, triggering cascading sell pressure as leverage unwound. This kind of move is typical after macro-driven pumps, where smart money sells first and lets volatility do the rest.

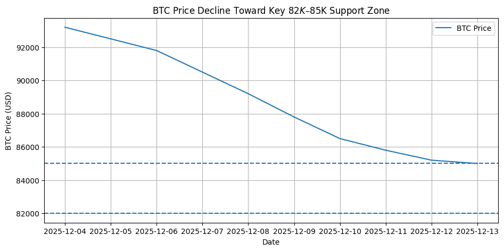

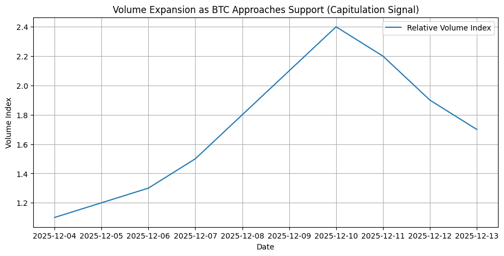

As price slipped from the low-$90Ks, on-chain data showed increased whale-to-exchange transfers, confirming that the move wasn’t retail-led panic but deliberate profit-taking. Once $88K failed to hold, sell-side momentum accelerated, pushing  $BTC quickly toward $85K. This flush has reset funding rates and removed excess leverage, which is constructive, but the market now needs to prove strength at key demand zones.

$BTC quickly toward $85K. This flush has reset funding rates and removed excess leverage, which is constructive, but the market now needs to prove strength at key demand zones.

The most important price zone right now is $82K–$85K. This area aligns with prior consolidation, high traded volume, and strong on-chain cost basis clusters. If BTC holds above this zone and shows absorption of sell pressure, it signals that whales are done distributing and larger players are accumulating again. A firm hold here opens the door for a rebound toward $88K–$90K.

However, a clean breakdown below $82K would shift momentum decisively bearish in the short term, exposing Bitcoin to a deeper retrace toward the $78K–$80K region, where the next major liquidity pocket sits. That level becomes critical for maintaining the broader bullish structure.

In summary, whale selling has driven  $BTC down to a decisive inflection point. As long as $82K–$85K holds, the move looks like a healthy reset rather than trend reversal. Lose it, and Bitcoin risks a deeper corrective phase before any meaningful continuation.

$BTC down to a decisive inflection point. As long as $82K–$85K holds, the move looks like a healthy reset rather than trend reversal. Lose it, and Bitcoin risks a deeper corrective phase before any meaningful continuation.

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research