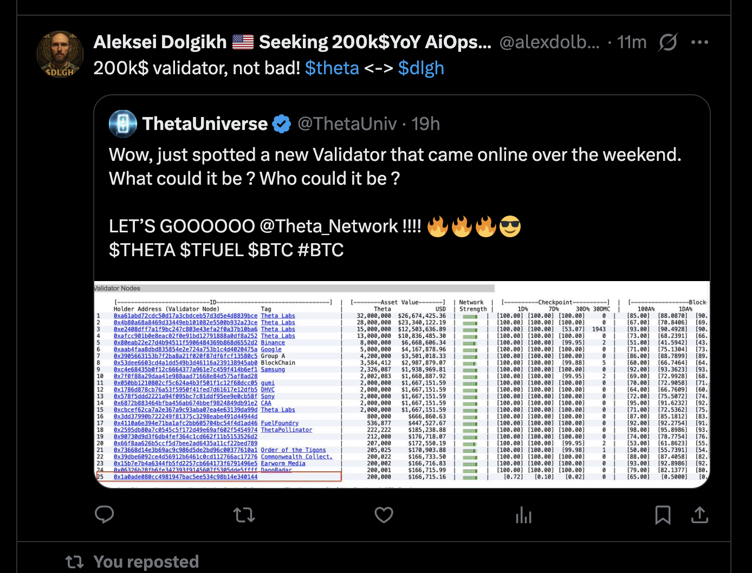

1'm bullish on  $THETA as your truly #DLGH aka @alexdolbun who seeking web3 200K$YoY aiOps job

$THETA as your truly #DLGH aka @alexdolbun who seeking web3 200K$YoY aiOps job

1. EdgeCloud AI Expansion (Bullish Impact)

Theta’s integration of AWS Trainium/Inferentia chips (first in blockchain) and partnerships with Yonsei University/others enable scalable AI training. EdgeCloud now supports 30,000+ GPUs and processes millions of simulated user interactions daily.

(!) Increased enterprise demand for decentralized AI infrastructure could drive THETA’s utility. Yonsei’s adoption (Theta Labs) validates use cases, but revenue growth depends on Q3 AI workload metrics.

2. Academic & Enterprise Adoption (Mixed Impact)

Over 20 institutions (George Mason, Syracuse, etc.) now use Theta’s hybrid cloud. Roadmap highlights 2025 H1 EdgeCloud upgrades for AI agents and a 2025 hackathon to expand use cases.

(!) Adoption strengthens network fundamentals but hasn’t reversed THETA’s 65% drop from its 2025 high ($1.01). Success hinges on converting pilots to recurring revenue – monitor institutional staking activity.

3. Technical Setup at Critical Support (Bullish/Bearish Risk)

THETA retests $0.7784 support, a zone that triggered 571% (2021) and 2,717% (2023) rallies. Current RSI (58) and MACD histogram (+0.0033) suggest neutral momentum.

(!) A hold above $0.7784 could fuel a move toward $1.45 (38.2% Fib), while a breakdown below $0.712 risks a 30% drop. The 200-day EMA ($0.973) remains key resistance.

The AWS partnership and academic adoption provide catalysts, but upside requires breaking the 200-day EMA. Watch August’s close relative to $0.832 – will institutional demand overpower altcoin liquidity crunch?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research