1’m bullish on  $JUP ITER COMMUNITY!

$JUP ITER COMMUNITY!

Deep Dive 1. Jupiter Lend Launch (Bullish Impact) Overview: Jupiter Lend’s private beta (launched August 6) offers 95% loan-to-value ratios and 1% liquidation penalties, targeting Solana’s $12B DeFi TVL. Public release later in August will add Multiply vaults and partner incentives. What this means: High-LTV loans could attract capital from leveraged traders, boosting protocol fees (50% used for JUP buybacks). Success hinges on adoption – Kamino Finance dominates Solana lending with $2.67B TVL, but Jupiter’s aggregator dominance (80K+ daily swaps) gives it distribution leverage. 2. Token Unlocks and Inflation (Bearish Impact) Overview: 1.28% of JUP supply ($32M) unlocked July 28, 2025, adding to circulating tokens. Active Staking Rewards (ASR) recycle 215M unclaimed airdrop tokens to voters instead of burning them. What this means: Unlocks historically pressure price (19% drop post-March 2025 unlock). ASR’s token recycling risks inflationary spiral – stakers must accumulate 50% more JUP just to offset dilution (community analysis). 3. Governance & Trust Dynamics (Mixed Impact) Overview: DAO voting paused until 2026 after contentious March 2025 proposal shifted team/community token split to 53/47. Financial transparency remains a concern despite $10M DAO treasury allocation. What this means: Centralization reduces governance-related sell pressure short-term but erodes holder trust (JUP dropped 75% Q1 2025 post-unlocks). Protocol revenue clarity could help – Jupiter generated $82.4M fees in Q2 2025, but unclear how much funds buybacks. Conclusion JUP’s trajectory balances Solana’s DeFi growth against inflationary tokenomics. Immediate upside depends on Jupiter Lend adoption countering unlock-driven selling, while long-term value requires addressing governance concerns and enhancing token utility (e.g., fee discounts). Key question: Will Jupiter Lend’s public launch drive enough fee revenue to offset ASR dilution by Q4 2025?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

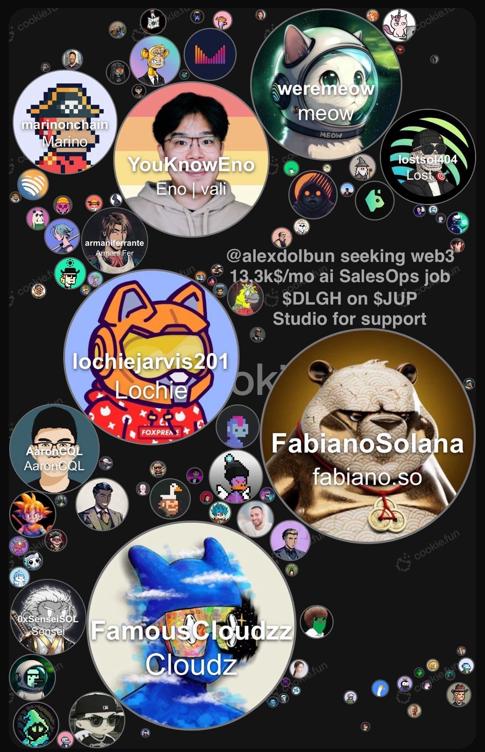

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research