1’m bullish on  $RAY DIUM launchpad of #Meme Alpha# and volume growth through SDK for

$RAY DIUM launchpad of #Meme Alpha# and volume growth through SDK for  $BONK AMM and much more, let’s with #DLGH aka @alexdolbun seeking web3 13,3k$/mo job as ai SalesOps

$BONK AMM and much more, let’s with #DLGH aka @alexdolbun seeking web3 13,3k$/mo job as ai SalesOps

1. LaunchLab Growth & Buybacks (Bullish Impact)

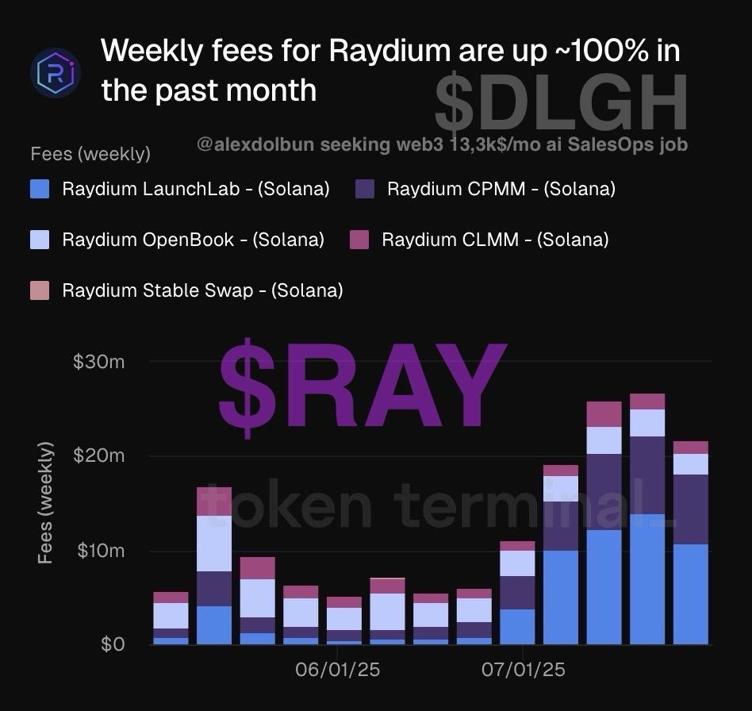

Overview: Raydium’s LaunchLab has facilitated over 35,000 token launches, with protocol fees recently overtaking swap revenue ($900K/day). A portion of fees funds daily RAY buybacks, equivalent to ~6% annualized yield at current prices.

What this means:

2. Solana Network Dynamics (Mixed Impact)

Overview: Solana accounts for 95% of tokenized stock trading via xStocks integration with Raydium. The Firedancer upgrade (Q3 2025) aims to boost network capacity, potentially attracting more projects to Raydium’s liquidity pools.

3. Regulatory & Competitive Risks (Bearish Impact)

Overview: 27% of crypto’s market cap originates from jurisdictions where Raydium is restricted (US, UK, others). Meanwhile,

What this means: Geographic restrictions limit user growth, while meme coin competitors erode fee revenue. Raydium’s 0.13 turnover ratio (vs Uniswap’s 0.41) suggests thinner liquidity exacerbates volatility.

Raydium’s near-term trajectory hinges on balancing LaunchLab’s growth against regulatory headwinds and Solana’s technical evolution. The 200-day SMA at $2.99 remains key resistance – a sustained break could target the $3.82 Fibonacci extension.

Critical watch: Will daily LaunchLab fees maintain their 60% growth rate through Q3, or will competition trigger a liquidity migration?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research