⚡ 𝐔.𝐒. 𝐖𝐞𝐚𝐥𝐭𝐡 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦𝐬 & 𝐁𝐢𝐭𝐜𝐨𝐢𝐧 𝐄𝐓𝐅𝐬: 𝐁𝐢𝐠 𝐌𝐨𝐧𝐞𝐲 𝐒𝐭𝐢𝐥𝐥 𝐋𝐨𝐜𝐤𝐞𝐝 𝐎𝐮𝐭

🔶 𝐓𝐡𝐞 𝐒𝐭𝐚𝐭𝐬:

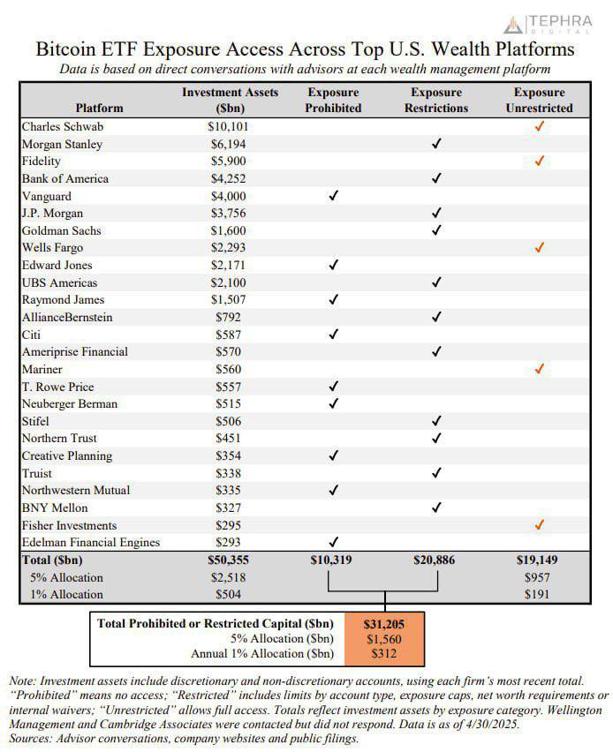

◆ Total U.S. wealth platform assets tracked: $50.3 trillion 💰

◆ Capital with prohibited Bitcoin ETF access: $10.3 trillion 🚫

◆ Capital with restricted access: $20.8 trillion ⚠

◆ Capital with full/unrestricted access: $19.1 trillion ✅

📊 𝐓𝐡𝐞 𝐁𝐢𝐠 𝐏𝐢𝐜𝐭𝐮𝐫𝐞

🔶 𝐓𝐨𝐭𝐚𝐥 𝐥𝐢𝐦𝐢𝐭𝐞𝐝 𝐜𝐚𝐩𝐢𝐭𝐚𝐥:

◆ Over $31.2 trillion still can’t freely invest in Bitcoin ETFs.

🔶 𝐏𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥 𝐢𝐦𝐩𝐚𝐜𝐭:

◆ A 5% allocation from this restricted pool could add $1.56 trillion to Bitcoin ETFs.

◆ Even a 1% allocation could inject $312 billion.

🚀 𝐖𝐡𝐚𝐭 𝐈𝐭 𝐌𝐞𝐚𝐧𝐬 𝐟𝐨𝐫 𝐁𝐢𝐭𝐜𝐨𝐢𝐧

🔶 𝐒𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐚𝐥 𝐛𝐚𝐫𝐫𝐢𝐞𝐫𝐬:

◆ Many platforms restrict access by account type, net worth, or require internal waivers.

🔶 𝐓𝐡𝐢𝐬 𝐰𝐨𝐧’𝐭 𝐥𝐚𝐬𝐭 𝐟𝐨𝐫𝐞𝐯𝐞𝐫:

◆ Regulatory shifts, client demand, and competitive pressure will likely open these gates.

💡 𝐊𝐞𝐲 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲

Once barriers fall, trillions in sidelined capital could pour into Bitcoin ETFs — fueling the next big leg up for BTC prices. 📈

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research