I'm bullish on  $M Perps! x100 leverage utilizer mr #DLGH aka @alexdolbun seeking for web3 13,3k$/mo job as ai salesops, with @CoinMarketCap #CMCAI launched by @CaptainRush at our 🇦🇪 Dubai #CMC VIP# event let's see inside ROADMAP of proj, let's GO SHARPLY Deep Dive:

$M Perps! x100 leverage utilizer mr #DLGH aka @alexdolbun seeking for web3 13,3k$/mo job as ai salesops, with @CoinMarketCap #CMCAI launched by @CaptainRush at our 🇦🇪 Dubai #CMC VIP# event let's see inside ROADMAP of proj, let's GO SHARPLY Deep Dive:

1. Near-term roadmap (0–6 months)

MemeX Liquidity Festival (August 4, 2025): A trading competition incentivizing liquidity provision for MRC-20 tokens, with undisclosed rewards (jayplayco).

CEX listing criteria reduction: Lowering FDV requirements from $5M to $1M for MRC-20 tokens to accelerate exchange listings (jayplayco).

Protocol Free bridge upgrades: Addressing high fees (e.g., 10 M minimum for BNB→MemeCore transfers) and reliability issues reported by users (jayplayco).

2. Long-term vision (6+ months)

Korean regulatory compliance: Finalizing acquisition of a KOSDAQ-listed firm to pursue VASP registration and ISMS certification by late 2025, enabling KRW/ $M swaps (Coingape).

$M swaps (Coingape).

Asia-Pacific expansion: Plans for Japan/Singapore launches in 2026, replicating Korea’s playbook of local partnerships and grant programs.

Meme 2.0 ecosystem: Expanding PoM consensus eligibility to more MRC-20 tokens, requiring them to meet volume/momentum thresholds for staking integration.

3. Critical context

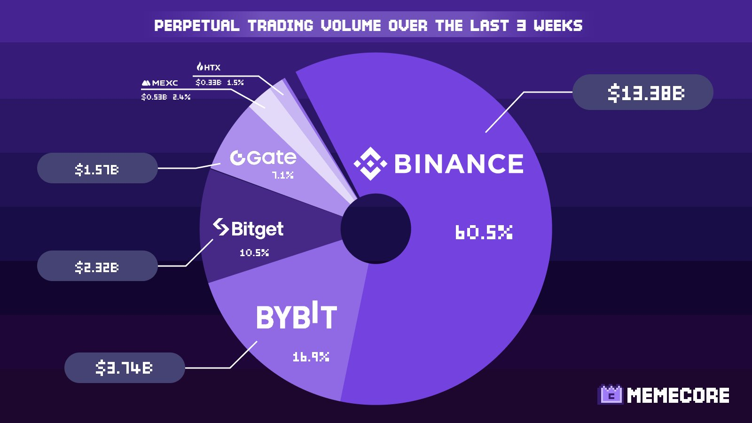

Liquidity dependency: 85% of  $M’s trading volume remains on PancakeSwap (BSC), creating friction for MemeCore-native activity (jayplayco).

$M’s trading volume remains on PancakeSwap (BSC), creating friction for MemeCore-native activity (jayplayco).

Regulatory uncertainty: #SouthKorea ’s FSC hasn’t yet approved any foreign blockchain for VASP status, risking timeline delays.

Validator requirements: Current PoM consensus mandates 7M  $M staked per validator, potentially centralizing network control.

$M staked per validator, potentially centralizing network control.

Conclusion

MemeCore’s success hinges on converting speculative hype into sustainable utility via its August liquidity push and Korean regulatory milestones.

Watchlist: Can MemeX’s festival metrics (TVL, unique participants) surpass July’s 598% price surge, or will it mirror previous post-graduation token dumps?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research