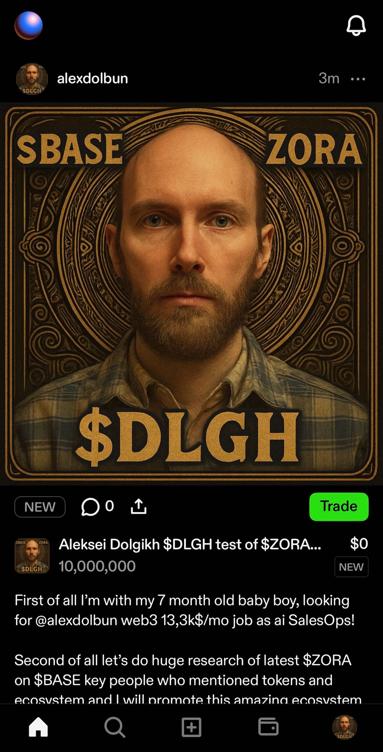

$ZORA meme #DLGH by me launched on

$ZORA meme #DLGH by me launched on  $BASE as well as profile creation DONE ✅ smoothly on

$BASE as well as profile creation DONE ✅ smoothly on

3. Technical Context: Overbought Signals Despite bullish momentum, indicators suggest exhaustion: • RSI 14: 81.03 (highest since May 2025) • MACD divergence: Histogram at +0.0068 but fading momentum • Key Fibonacci resistance: $0.0785 (23.6% retracement level) The 24h trading range ($0.068–$0.085) shows consolidation after July 27’s ATH at $0.10.

Conclusion ZORA’s surge combines organic SocialFi growth with speculative leverage – a high-risk cocktail. While network metrics like creator payouts and token burns suggest lasting utility, RSI levels and derivatives overhang imply heightened volatility risk. Watchlist: Can ZORA hold above its 7-day EMA ($0.065) if Bitcoin dominance rebounds to 61%?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research