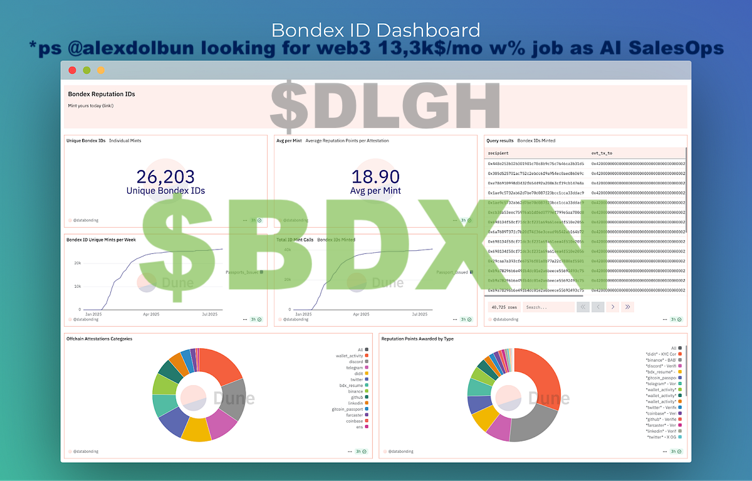

I'm bullish on  $BDXN with #DLGH highlight of #Web3Jobs platforms as @alexdolbun looking for web3 13,3k$/mo w% job as Ai SalesOps on Bondex platform. Let's ask @CoinMarketCap #CMCAI to Deep Dive

$BDXN with #DLGH highlight of #Web3Jobs platforms as @alexdolbun looking for web3 13,3k$/mo w% job as Ai SalesOps on Bondex platform. Let's ask @CoinMarketCap #CMCAI to Deep Dive

1. Market Metrics & Sentiment

BDXN’s price fell 96.51% in 90 days to $0.0322 (24 July 2025), reflecting weak confidence despite retail traders’ bullish posts like “BDXN breakout confirmed 🚀” (CoinMarketCap). The token’s 24-hour trading volume ($5.93M) and turnover ratio (1.16) suggest thin liquidity, amplifying volatility risks.

2. Tokenomics & Unlock Risks

Supply dynamics: 84% of BDXN’s 1B max supply remains locked, with 94% of airdropped tokens set to unlock over 9–15 months (CoinMarketCap).

Early investor pressure: OBNX holders converted to BDXN at 4:1 in November 2024 could sell once vested.

3. Platform Adoption Challenges

Bondex positions as a Web3 LinkedIn but shows limited traction:

- Low fees: Job postings cost $0.34 on average, generating minimal buyback revenue.

- Unproven adoption: No data on active users among 4.7M airdrop recipients.

Conclusion

BDXN’s path hinges on converting airdrop claims into active users before token unlocks intensify selling pressure. While event-driven hype may spark rallies, sustainable growth requires measurable HR/corporate adoption.

Watchlist: Can Bondex’s Dubai event (24 July 2025) clarify governance and user retention strategies?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research