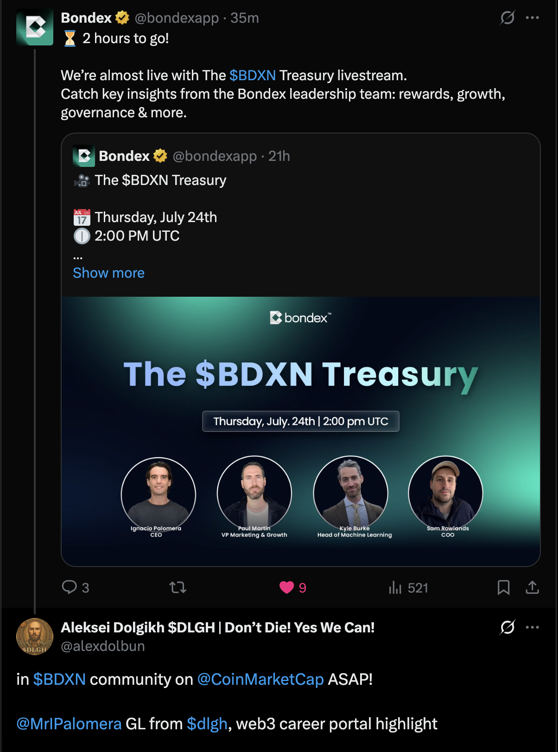

I'm bullish on  $BDXN event after more than 1 hour, join! Let's with #DLGH and launched at #CMC VIP# Dubai 🇦🇪 event by @CaptainRush CEO @CoinMarketCap the #CMCAI Deep Dive Into #Bondex "What are people saying about BDXN?"

$BDXN event after more than 1 hour, join! Let's with #DLGH and launched at #CMC VIP# Dubai 🇦🇪 event by @CaptainRush CEO @CoinMarketCap the #CMCAI Deep Dive Into #Bondex "What are people saying about BDXN?"

1. Sentiment Overview

Retail traders on CoinMarketCap and X (Twitter) dominate bullish chatter, with posts like “BDXN breakout confirmed 🚀” (20 July 2025) and “still a good buy!” driving short-term optimism. However, deeper analysis reveals bearish undercurrents:

- Price action: BDXN fell 96.51% over 90 days to $0.0322 (24 July 2025), reflecting weak confidence in fundamentals.

- Institutional caution: A detailed CoinMarketCap community analysis (19 July 2025) highlights concerns about 4.7M airdrop recipients failing to convert into active users and unclear governance mechanisms.

2. Key Discussion Themes

A. Tokenomics and Unlocks

- 84% of BDXN’s max supply remains locked, with 94% of airdropped tokens unlocking over 9-15 months. Analysts warn this could suppress prices until 2026 unless adoption accelerates.

- Early OBNX holders received a 4:1 conversion to BDXN in November 2024, creating a potential overhang of early investors awaiting exits.

B. Platform Utility

- Bondex markets itself as a crypto-native LinkedIn, offering BDXN rewards for job postings ($0.34 avg fee) and referrals. Critics note low transaction fees and unproven corporate/HR adoption.

- Skeptics argue the revenue-sharing model (buybacks funded by platform income) lacks scalability without mass user growth.

Conclusion

BDXN’s fate hinges on converting its 4.7M airdrop users into active participants before token unlocks intensify selling pressure. While social media hype fuels short-term volatility, the project needs measurable progress in user retention and corporate partnerships to justify its Web3 professional networking thesis.

What metrics could signal a turnaround in Bondex’s adoption trajectory?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research