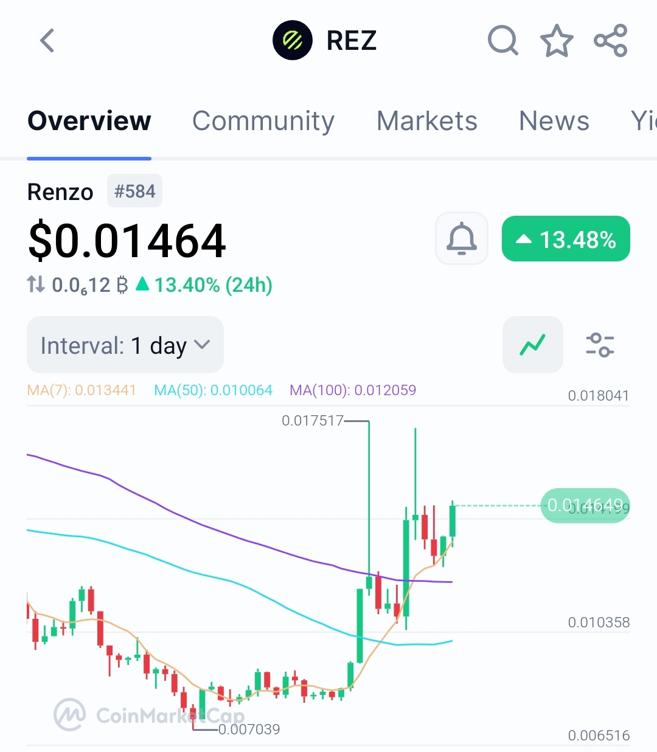

Renzo’s price rose 7.77% in 24 hours due to strategic protocol upgrades, whale accumulation, and bullish technical indicators.

Cross-chain bridge launch unlocked $1.1B TVL, tightening circulating supply.

Institutional restaking vaults boosted demand for REZ.

Technical breakout above key moving averages signaled bullish momentum.

Deep Dive

1. Primary Catalyst: Cross-Chain Expansion

Renzo’s price surged after launching a cross-chain liquidity bridge on Ethereum, BNB Chain, and Polygon on 16 July 2025 .

This Enabled seamless minting of synthetic assets, expanding Renzo’s DeFi use cases.

Triggered whale accumulation, reducing circulating supply to 3.26B REZ (from 3.27B).

Preceded a governance vote (scheduled for next week) on yield-optimizing strategies, fueling speculation.

The bridge’s $1.1B TVL influx aligns with Renzo’s $969M pre-launch TVL, reinforcing its role in EigenLayer’s restaking ecosystem.

2. Technical Context

REZ broke above critical levels:

7-day SMA ($0.0129) and 30-day EMA ($0.0109), confirming short-term bullish momentum.

RSI 14 at 64.57 (neutral-bullish), avoiding overbought territory.

MACD histogram (+0.00045) widened, signaling accelerating upward pressure.

The price now tests Fibonacci resistance at $0.01504 (23.6% retracement). A close above this level could target $0.0175 (swing high).

Conclusion

Renzo’s 24-hour rally reflects a blend of strategic ecosystem growth, supply dynamics, and technical strength. Watch for sustained volume above $20M and progress toward the $0.015 resistance.

Will institutional inflows via Flow Vaults offset the 3.17% token unlock on 31 July?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research