Chainbase (C) surged 82.94% in 24 hours due to its Binance listing, airdrop rewards for BNB holders, and bullish AI/Web3 infrastructure sentiment.

Binance listing triggered a 229% intraday price spike.

Market-wide rally fueled risk-on altcoin demand.

AI/data narrative amplified interest in Chainbase’s use case.

Deep Dive

1. Primary Catalyst: Binance Integration

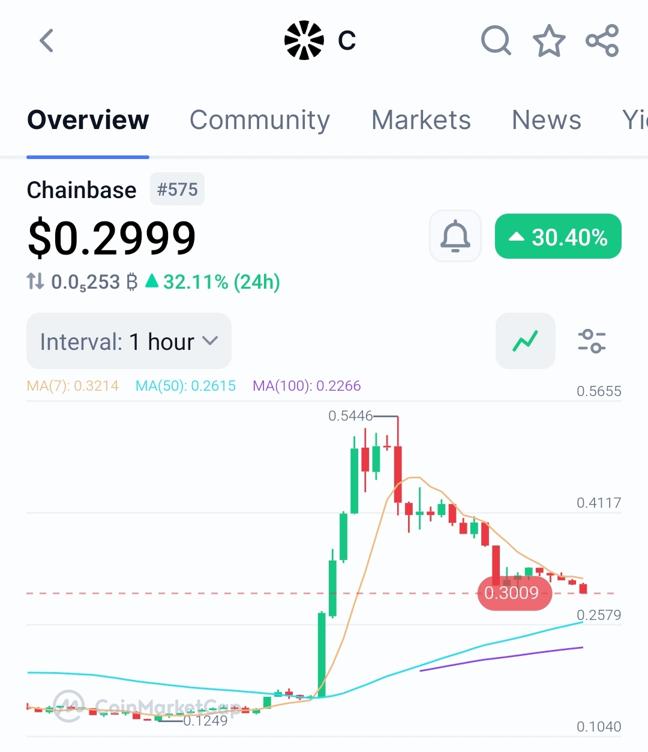

Binance listed C on July 18, 2025, enabling spot trading (C/USDT, C/BNB) and adding it to Simple Earn, Margin, and Futures. The exchange also distributed 20M C tokens (2% supply) via a retroactive airdrop to BNB holders. This created immediate buying pressure, with C rising from $0.125 to $0.51 within hours.

2. Supporting Factors

Macro tailwinds: The crypto market hit $4T amid U.S. crypto bill approvals and speculation about retirement account crypto exposure.

AI/Web3 hype: Chainbase’s focus on structuring blockchain data for AI models aligned with NVIDIA’s $4T valuation surge after eased U.S.-China chip restrictions.

Exchange momentum: Prior listings on BitMart (July 14) and Biconomy (July 15) built liquidity before Binance’s “mainstage” debut.

3. Technical Context

Volume surge: 24h trading volume spiked 1,268% to $467M, confirming retail participation.

Volatility: The price retraced 40% from its $0.51 peak to $0.308 by July 19, reflecting profit-taking after the initial listing frenzy.

Conclusion

Chainbase’s price surge reflects the “Binance Effect,” macro optimism, and AI narrative convergence. However, sustaining gains depends on post-listing utility growth and broader market stability.

What metrics could signal whether C’s AI/data adoption is translating beyond exchange-driven speculation?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research