SUI’s 6.5% 24-hour drop reflects profit-taking after a multi-week rally, cooling derivatives activity, and sector rotation into newer altcoin narratives.

Profit-taking after SUI’s 33% 30-day gain and overbought RSI (70.26)

Derivations cooling: Open interest dipped 15% to $1.79B as traders reduced leveraged longs

Altcoin rotation: Capital shifted toward tokens like XRP (+17%) and AVAX (+14%)

Deep Dive

1. Technical Correction

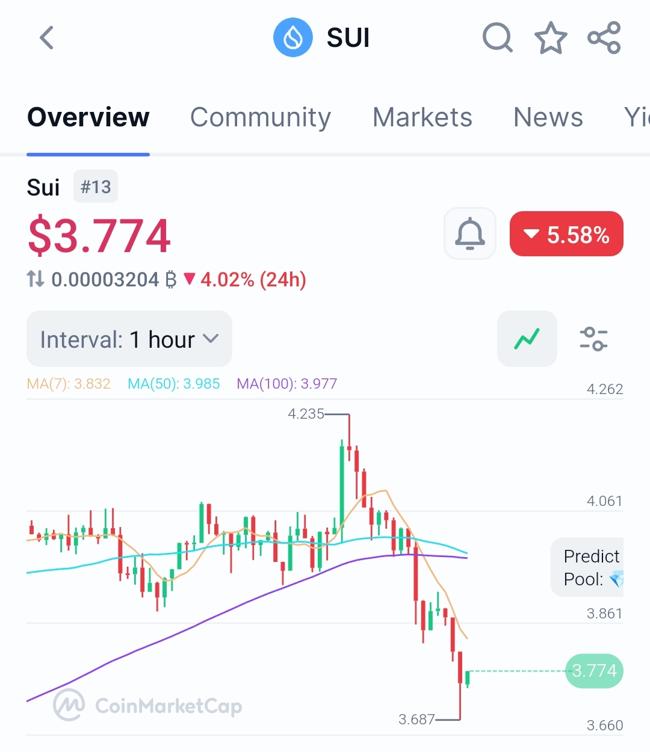

SUI’s RSI (70.26) signaled overbought conditions after a 33% 30-day rally to $4.10. The pullback found initial support at $ 3.68 (23.6% Fibonacci retracement), aligning with its 7-day SMA ($ 3.74).

MACD histogram narrowed to +0.12, showing fading bullish momentum

Volume dipped 18% to $ 3.35B, confirming reduced buying pressure

2. Derivatives Reset

SUI’s derivatives market saw long unwinding:

Open interest: Fell from $2.12B to $1.79B (-15%) as traders closed positions (CoinMarketCap)

Funding rate: Dropped to 0.0083%, down 89% from July 17 peaks (CoinMarketCap)

Liquidations: $6.1M longs vs. $2.9M shorts liquidated in 24h

Conclusion

SUI’s dip appears corrective rather than structural, driven by natural profit-taking and reduced leverage. With Bitcoin dominance falling to 60.96% and altcoin season sentiment rising (+81% in 30 days), SUI could rebound if it holds $3.68 support.

What catalyst could reignite SUI’s uptrend – sustained TVL growth or a breakout above $4.20?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research