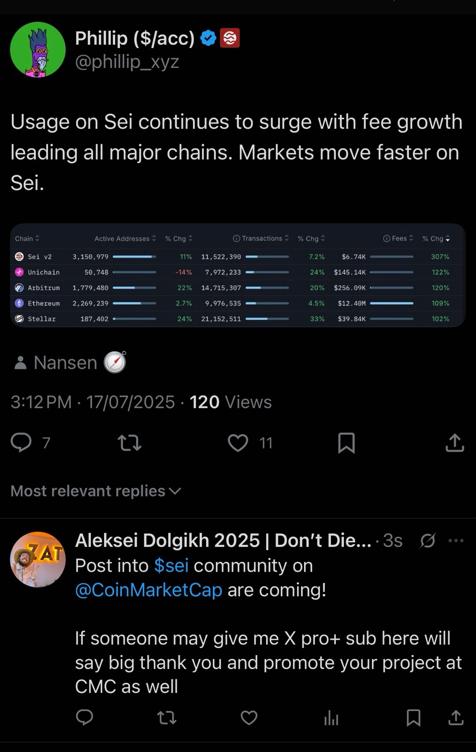

1’m bullish on  $SEI network as latest data of transactions is GROWING! As well let’s ask @CoinMarketCap community #CMC VIP# launched in Dubai 🇦🇪 by @CaptainRush tool #CMCAI more info Deep Dive

1. Project-Specific Catalysts

• Giga Upgrade: The July 2025 upgrade aims to boost EVM throughput by 50x via parallel processing, targeting 200K TPS and sub-400ms finality (Sei Labs). This could attract Ethereum developers seeking scalability.

• ETF Momentum: Canary Capital’s U.S. staked-SEI ETF filing (April 2025) awaits SEC review. Approval could mirror Bitcoin ETF inflows, but delays might dampen sentiment.

• Wyoming Partnership: SEI is shortlisted for Wyoming’s WYST stablecoin pilot, with deployment expected by July 17 (CoinDesk). Regulatory endorsement could enhance institutional credibility.

2. Technical Outlook

• Bullish Signals: Price ($0.364) trades above key SMAs (30-day: $0.27, 200-day: $0.25) and broke resistance at $0.30. MACD histogram (+0.0069) and RSI (72.2) suggest momentum but warn of overbought conditions.

• Key Levels: Immediate resistance at $0.389 (swing high); a close above $0.40 could target $0.45–$0.53 (Fibonacci extensions). Support lies at $0.30–$0.27.

3. Market & Competitive Landscape

• Altcoin Rotation: SEI rose 41% in July 2025 as CryptoQuant’s altcoin season index hit 39/100, its highest since June 2024 (CoinDesk).

• TVL Growth: SEI’s Total Value Locked hit $682M (+31% MoM), driven by DeFi protocols like Dragonswap. However, rivals like SUI (+36%) and Solana compete for developer mindshare.

$SEI network as latest data of transactions is GROWING! As well let’s ask @CoinMarketCap community #CMC VIP# launched in Dubai 🇦🇪 by @CaptainRush tool #CMCAI more info Deep Dive

1. Project-Specific Catalysts

• Giga Upgrade: The July 2025 upgrade aims to boost EVM throughput by 50x via parallel processing, targeting 200K TPS and sub-400ms finality (Sei Labs). This could attract Ethereum developers seeking scalability.

• ETF Momentum: Canary Capital’s U.S. staked-SEI ETF filing (April 2025) awaits SEC review. Approval could mirror Bitcoin ETF inflows, but delays might dampen sentiment.

• Wyoming Partnership: SEI is shortlisted for Wyoming’s WYST stablecoin pilot, with deployment expected by July 17 (CoinDesk). Regulatory endorsement could enhance institutional credibility.

2. Technical Outlook

• Bullish Signals: Price ($0.364) trades above key SMAs (30-day: $0.27, 200-day: $0.25) and broke resistance at $0.30. MACD histogram (+0.0069) and RSI (72.2) suggest momentum but warn of overbought conditions.

• Key Levels: Immediate resistance at $0.389 (swing high); a close above $0.40 could target $0.45–$0.53 (Fibonacci extensions). Support lies at $0.30–$0.27.

3. Market & Competitive Landscape

• Altcoin Rotation: SEI rose 41% in July 2025 as CryptoQuant’s altcoin season index hit 39/100, its highest since June 2024 (CoinDesk).

• TVL Growth: SEI’s Total Value Locked hit $682M (+31% MoM), driven by DeFi protocols like Dragonswap. However, rivals like SUI (+36%) and Solana compete for developer mindshare.

Conclusion SEI’s trajectory hinges on the Giga upgrade’s adoption, ETF approvals, and Bitcoin’s stability. While bullish momentum is clear, overextension risks a pullback. Could Wyoming’s WYST launch on July 17 catalyze SEI’s next leg toward $0.50?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research