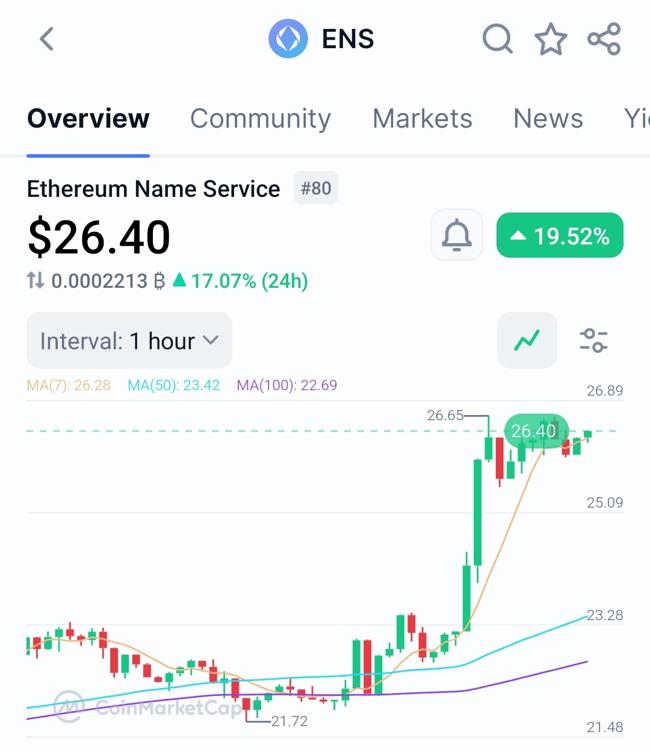

Ethereum Name Service (ENS) rose 19% in 24h due to Coinbase Germany listing, whale accumulation, and bullish technicals.

Coinbase Germany listing boosted accessibility and speculation

Whale activity surged 313% in early July per Santiment

Technical breakout above key resistance at $23.47 pivot point

Deep Dive

1. Primary catalyst

ENS was among 16 tokens added to Coinbase Germany on July 10, expanding access to Europe’s largest crypto market. Listings typically trigger:

Immediate liquidity influx (24h volume up 203% to $382M)

Speculative positioning from retail traders

Follow-on coverage from crypto media outlets

2. Technical context

ENS broke above its 30-day SMA ($19.58) and pivot point ($23.47) with:

RSI14 at 72.36 (approaching overbought)

MACD bullish crossover (0.82 vs 0.24 signal line)

Next resistance at $26.71 (127.2% Fibonacci extension)

The move liquidated $2.1M in shorts within 24h, amplifying upside momentum.

Conclusion

ENS’s rally combines exchange-driven liquidity, technical momentum, and Ethereum ecosystem growth (ENSv2/L2 plans). With altcoin season index rising 32% monthly,

can ENS sustain momentum above its 200-day EMA at $20.85 despite overextended RSI?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research