Bounce Token (AUCTION) surged 27.55% in 24h due to bullish app upgrade news and technical breakout momentum.

App upgrade announcement (8 July) highlighted new RWA and token utility features

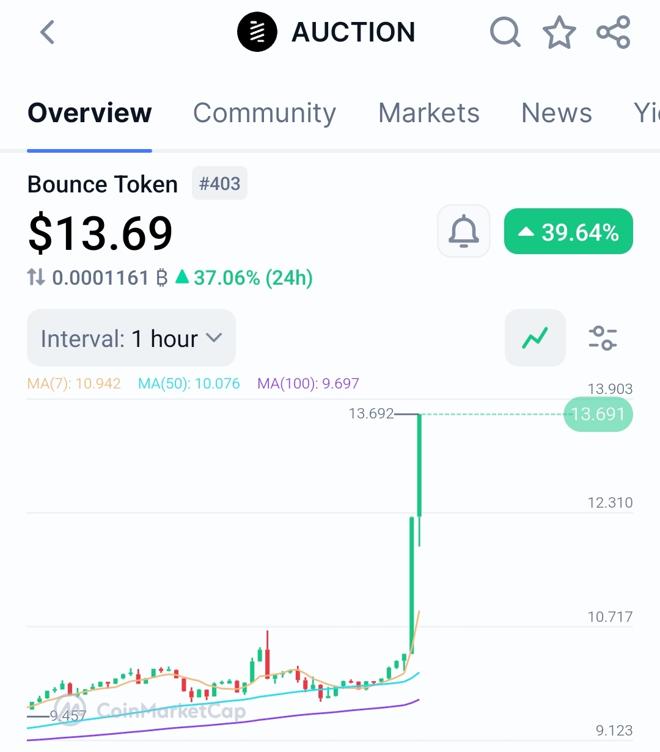

Technical breakout above key moving averages with 746% volume spike

Overbought RSI (76.63 on 1h) signals short-term consolidation risk

Deep Dive

1. Primary Catalyst

The 8 July announcement of Bounce app upgrades (Bounce Finance) outlined four key enhancements:

RWA auctions (Bounce Art)

Dedicated  $AUCTION holder hub

$AUCTION holder hub

Decentralized trading (Permissionless)

Launchpad services (Premium)

This aligns with crypto’s current focus on real-world assets (RWA) and improved token utility, driving speculative buying that materialized 4 days later as markets digested the roadmap.

2. Technical Context

Price broke above critical moving averages:

7-day SMA ($9.4) and EMA ($9.52)

30-day SMA ($9.16) and EMA ($9.46)

The 746% 24h volume spike to $173M confirms conviction behind the move. However, the 1h RSI hit 76.63 on 12 July (CMC Community), entering overbought territory that historically precedes 5-10% pullbacks in AUCTION.

3. Market Dynamics

While the broader crypto market rose 10.31% weekly, AUCTION’s 43.57% 7d gain shows outperformance driven by:

Low float: 6.09M circulating supply (80% held by top 10 wallets) amplifies volatility

Sector rotation: Neutral Altcoin Season Index (28) suggests coin-specific vs market-wide drivers

Conclusion

AUCTION’s surge combines project-specific catalysts with technical momentum, though whale concentration (75% supply) and overbought signals warrant caution.

Will RWA adoption through Bounce Art sustain demand beyond this speculative spike?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research