I'm bullish on  $USDC on

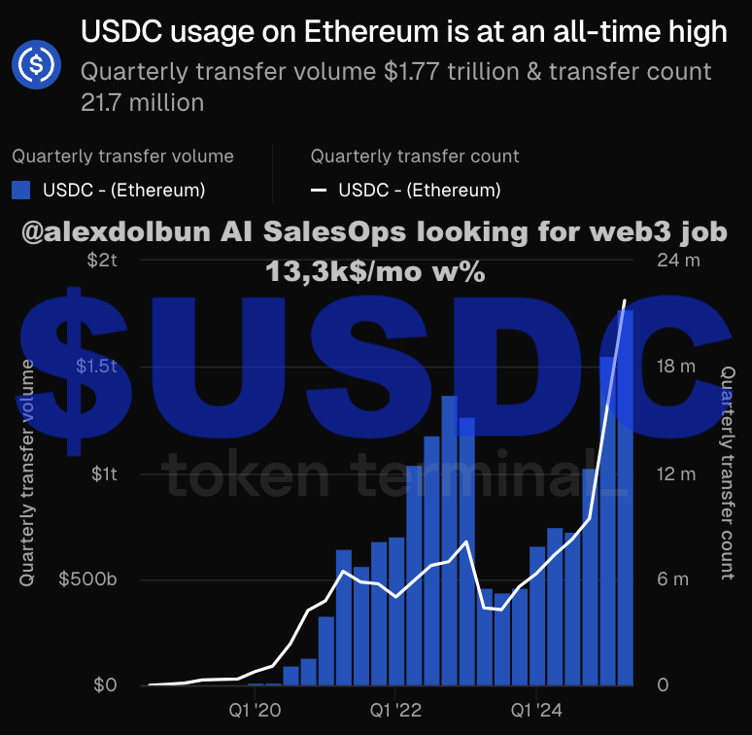

$USDC on  $ETH as the volume on ATH but

$ETH as the volume on ATH but  $SEI will eat them as their investor Circle IPOed from 31 USD to 240 USD for share and them much more faster! What's the latest news on USDC #StableCoin let's ask @CoinMarketCap #CMCAI and together Deep Dive

$SEI will eat them as their investor Circle IPOed from 31 USD to 240 USD for share and them much more faster! What's the latest news on USDC #StableCoin let's ask @CoinMarketCap #CMCAI and together Deep Dive

1. Business & partnerships

Ant Group integration: Jack Ma’s fintech giant plans to use USDC for cross-border treasury operations and payments across its blockchain network (John Morgan). This follows Circle’s IPO surge (CRCL shares up 500% since June 2025 listing).

OKX liquidity deal: Zero-fee USD⇄USDC conversions launched July 9 for 60M+ users, supported by Standard Chartered/DBS banking rails (Circle).

Bybit revenue sharing: Circle now splits USDC reserve interest income with the exchange, mirroring existing Coinbase/Binance arrangements.

2. Regulatory & external factors

US GENIUS Act: Senate-approved bill (June 2025) mandates FDIC-like insurance for stablecoins, favoring USDC’s audit-first approach over Tether’s model.

EU MiCA enforcement: Completed July 1, causing exchanges to delist non-compliant stablecoins - USDC now accounts for 74.6% of institutional OTC deals in Europe (Finery Markets).

Dark stablecoin debate: CryptoQuant CEO warns tightening regulations may drive demand for censorship-resistant alternatives, though USDC’s compliance focus remains its key institutional edge.

3. Market metrics

Supply surge: +40.4% YTD to $62.8B market cap, narrowing Tether’s lead to 2.5:1 ratio vs 3:1 in 2024 (CoinMarketCap).

On-chain activity: 15.6B daily transaction volume (+53% QoQ), with 61% of addresses holding >$1k USDC indicating growing retail/merchant adoption.

Conclusion

USDC’s regulatory alignment and enterprise partnerships position it as the stablecoin of choice for TradFi integrations, though Tether’s liquidity dominance persists. How will MiCA’s full implementation and the GENIUS Act’s House vote reshape the $257B stablecoin market through 2025?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research