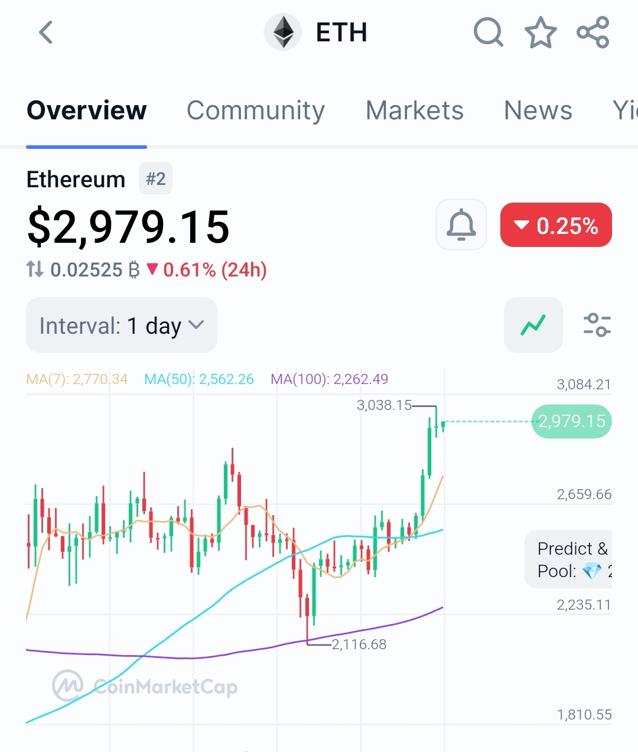

Ethereum’s 1.12% price dip in 24 hours reflects profit-taking after an 18% weekly rally, amplified by institutional selling and mixed ETF flows.

Ethereum Foundation’s 10,000 ETH OTC sale sparked concerns about strategic selling

$204.9M ETH ETF inflows countered by 69,440 ETH spot market exits

Overbought technicals (RSI7 at 83.4) triggered profit-taking

Deep Dive

1. Primary Catalyst: Strategic ETH Sales

The Ethereum Foundation sold 10,000 ETH ($25.7M) via OTC to SharpLink Gaming on July 10 (Ethereum Foundation). While OTC deals avoid direct market impact, the timing (after ETH’s 18% weekly gain) amplified fears of institutional profit-taking. Concurrently, 69,440 ETH ($205M+) was sold on exchanges despite $204.9M ETF inflows, creating net selling pressure.

2. Technical Context: Overextended Rally

ETH’s RSI7 hit 83.4 (strong overbought) on July 11, its highest since May 2025. Historically, RSI7 >80 correlates with 5-10% corrections as traders lock gains. The MACD histogram (+53.06) shows bullish momentum but has narrowed since July 9, signaling fatigue. Key Fibonacci support sits at $2,820 (23.6% retracement), which ETH tested briefly during the dip.

3. Market Dynamics: BTC Dominance Shift

Bitcoin ETFs saw $1.03B inflows vs. ETH’s mixed flows, driving BTC dominance to 63.67% (+0.17% in 24h). The Altcoin Season Index fell to 27 (-3.6%), suggesting capital rotation toward BTC. ETH’s 24h volume fell 34.8% to $26.5B, indicating weaker conviction during the pullback.

Conclusion

ETH’s dip combines profit-taking from overbought conditions, strategic OTC sales, and shifting capital to BTC ETFs. While the 18% weekly gain remains intact, watch the $2,820 support and ETF flow reversals.

Could ETH’s staking adoption through SharpLink offset near-term selling pressure?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research