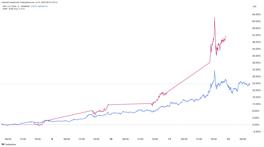

$XRP just crossed $170B in market cap — but this run is far from over.

$XRP just crossed $170B in market cap — but this run is far from over.

Ripple has flipped the script on global finance. With ISO 20022 compatibility and sub-$10 settlement costs,  $XRP is replacing SWIFT one institution at a time. Real utility, real rails, real momentum.

$XRP is replacing SWIFT one institution at a time. Real utility, real rails, real momentum.

Institutional flows are ramping up. $250M just moved into  $XRP ETFs. Robinhood and Bitstamp are building a derivatives exchange on XRPL. Over 10 XRP spot ETF filings are pending—rumors even say BlackRock is watching closely.

$XRP ETFs. Robinhood and Bitstamp are building a derivatives exchange on XRPL. Over 10 XRP spot ETF filings are pending—rumors even say BlackRock is watching closely.

Ripple’s bid for a national bank charter could bring RLUSD under full U.S. federal regulation. That alone would flip the switch for heavy institutional adoption. Meanwhile, central banks are exploring XRP for #CBDC settlement, with real pilots already in play.

Grayscale re-added XRP to #GDLC and tried to convert it to a spot ETF—approval came, then got paused. But analysts believe an approval is still on deck.

The #XRP Ledger is no longer just active. It’s becoming core crypto infrastructure. Liquidity is rising fast. Market volume jumped 37% in 24 hours, now above $7.3B.

This isn’t noise. It’s a coordinated setup. XRP is approaching an all-time high—and this time, it’s not just about charts.

The next leg could mint more millionaires than any previous cycle. And most won’t even see it coming.

LFG

Ripple’s ETF hits $250M as  $XRP spikes to $2.96, boosted by BTC momentum, leveraged product demand, and Garlinghouse’s CLARITY Act advocacy. Institutional interest grows.

$XRP spikes to $2.96, boosted by BTC momentum, leveraged product demand, and Garlinghouse’s CLARITY Act advocacy. Institutional interest grows.

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research