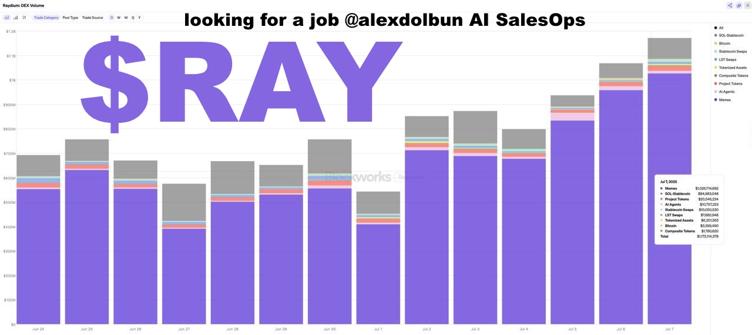

I'm bullish on  $RAY broski where to find

$RAY broski where to find  $SOL to stake there and to trade through SDK with some cool AMM strategies?

$SOL to stake there and to trade through SDK with some cool AMM strategies?

1. Release Type & Scope

The V3 Beta represents Raydium's first major protocol upgrade since 2024, focusing on:

- Full integration with OpenBook's decentralized order book

- Expanded liquidity access for both AMM pools and limit orders

- Core smart contract modifications to enable cross-venue liquidity aggregation

2. Key Modifications

Hybrid Liquidity Model: Combines traditional AMM pools with real-time order book data, allowing market makers to set precise price levels (Raydium V3 Documentation)

Smart Order Routing: New algorithm scans all liquidity sources (including Serum-v2 forks) to minimize slippage

Pool Creation Tools: Simplified interface for launching permissionless pools with customizable fee structures

3. Impact on Users & Devs

Traders gain access to ~40% more liquidity across Solana DeFi through shared order books

Projects can bootstrap liquidity with 85% lower initial capital requirements compared to V2

Requires no immediate action from existing liquidity providers - backward compatibility maintained through wrapper contracts

Conclusion

The V3 upgrade positions Raydium as Solana's liquidity backbone by merging AMM flexibility with order book precision, though success hinges on OpenBook's network effects. How will TVL trends and swap volume respond to these structural improvements in Q3 2025?

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research