🚀  $BNB : Path to $740 or Correction? Brief Analysis

$BNB : Path to $740 or Correction? Brief Analysis

BNB is at a crossroads — its price depends on deflationary tokenomics, ecosystem growth, and regulatory developments.

Growth Drivers:

- Auto-burn: Supply will drop from ~142M to 100M by 2028. In Q1 2025, 1.94M BNB (~$1.17B) were burned.

- Maxwell Hardfork: Network speed improved (0.75 sec/block), and AI integration may attract new projects.

- $100M Ecosystem Fund: Supports AI, DeFi, and RWA initiatives.

Market Data:

- DEX Leader: $14.23B daily volume, but competition with Solana and Ethereum remains strong.

- Stablecoins: $10B on #BNB Chain (+3.2% MoM) signals liquidity retention.

Technical Outlook:

- Consolidation between $624 and $679. A breakout could target $740.

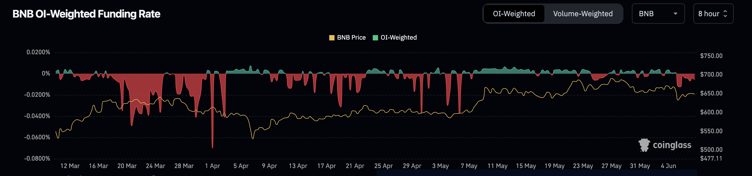

- MACD (-5.59) and declining open interest signal short-term caution.

Regulatory Factor:

- ETF Potential: VanEck’s BNB ETF filing could unlock institutional inflows.

- Risks: Although SEC pressure has eased, global sanctions remain a concern.

Conclusion:

BNB enters a key phase — the burn mechanism and upgrades support bullish potential, but consolidation and regulatory uncertainty require caution.

Can the burn rate offset competition from Solana and Ethereum?

Share your thoughts 👇

Follow my market research here 👉

Most Visited

Most Visited Community Sentiment

Community Sentiment Chain Ranking

Chain Ranking Crypto

Crypto Politics

Politics Sports

Sports Overall NFT Stats

Overall NFT Stats Upcoming Sales

Upcoming Sales Market Cycle Indicators

Market Cycle Indicators Bitcoin Dominance

Bitcoin Dominance RSI

RSI MACD

MACD Funding Rates

Funding Rates Signals

Signals Trending

Trending New

New Gainers

Gainers Meme Explorer

Meme Explorer Top Traders

Top Traders Feeds

Feeds Topics

Topics Lives

Lives Articles

Articles Research

Research