The Terra co-founder reportedly attempted to leave Montenegro and fly to Dubai using Costa Rican travel documents.

Listen to the CoinMarketRecap podcast on Apple Podcasts, Spotify and Google Podcasts

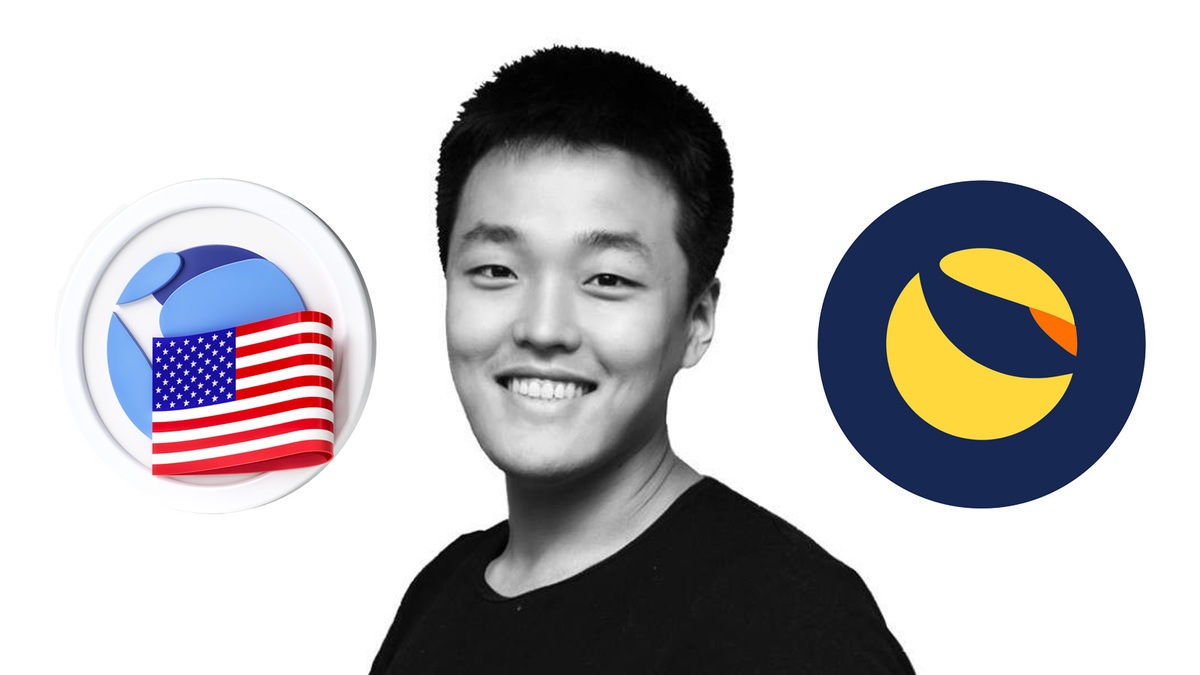

Hours after the fugitive founder of the collapsed UST stablecoin was arrested in Montenegro, federal prosecutors in New York charged him with eight counts of fraud and market manipulation.

At the time, SEC Chairman Gary Gensler accused Terraform Labs and Kwon of committing "fraud by repeating false and misleading statements to build trust before causing devastating losses for investors."

The Winds of Crypto Winter

The UST/LUNA ecosystem collapse destroyed an estimated $48 billion in value and was responsible for many of the other industry bankruptcies that worsened the crypto winter.

Do Kwon has been charged with conspiracy to defraud, two counts of commodities fraud, securities fraud, wire fraud, and conspiracy to defraud and engage in market manipulation by Damian Williams, the U.S. Attorney for the Southern District of New York.

While short on details, the U.S. indictment cites "false and misleading statements" made during interviews on Oct. 14 and Oct. 30, 2020 "about the extent to which the Terra blockchain had been adopted by users.

It also alleged that in May 2021, which Do Kwon and a representative of an unnamed "U.S. trading and investment firm" with staff in the Southern District — which includes Wall Street and Manhattan — agreed to deploy trading strategies designed to alter the market price of UST.

In exchange, Kwon "agreed to modify an existing loan" between Terraform Labs and that firm to compensate it for its assistance in manipulating the price of UST, the charges claim.

The indictment cites "false and misleading statements concerning the effectiveness and sustainability of the algorithmic mechanism that purportedly ensured the stability of UST's price" made in a Terraform Labs social media post on May 24, 2021, and in an interview on March 1, 2022.