Make passive income from DeFi

Learn how to use PlasmaFinance to locate profitable Liquidity Mining opportunities.

All right. So we’ve just learnt how PlasmaFinance can help you navigate and use DeFi more easily, more conveniently, yet with more peace of mind. But we all know that people come to use DeFi for those amazing yields, right?

Making passive income from DeFi basically involves committing your crypto assets that would otherwise be sitting idle into different financial services. Early DeFi protocols were based on lending, but the most popular today are referred to as Liquidity Mining and Staking (followed by more advanced methods like Yield Farming).

But with so many to choose from, how do you know where to start? This is where PlasmaFinance can make a huge difference to the savvy DeFi trader. Here’s how.

1. Liquidity Mining: find the best opportunities instantly

One of the most popular DeFi activities today is called Liquidity Mining. You may also have heard of users calling themselves Liquidity Providers (LPs), using LP tokens to earn high APYs (Annual Percentage Yield). This is probably the most active sector within DeFi, as the most popular DEXs out there like Uniswap and SushiSwap (and our own PlasmaSwap) are all Automated Market Maker (AMM) DEXs that center trading activity around Liquidity Pools.

To incentivize people to provide their idle crypto assets to these liquidity pools, they share a portion of the fees or commissions made on every swap in that pool, thereby returning consistent passive income to people willing to provide liquidity to DEXs. PlasmaFinance makes it so easy to earn from liquidity mining -- the process by which users add their crypto capital to a common pool and earn a portion of all fees generated.

Of course, coming across a good Liquidity Pool that can give good APY returns can be quite difficult on its own, especially with hundreds of new pools coming up every day. It may appear safer to stick with recognized asset pools with high volume and deep liquidity -- it stands to reason these will be the most popular and thus, generate the most revenue. On the other hand, the best LPs hunt for DeFi gems, trying to locate the assets and pools with the best potential to provide liquidity early and gain the most when these pools gain traction.

This is where a DEX aggregator like PlasmaFinance will prove to be useful for you.

It all begins with our Liquidity Pools page, where you can find real-time, transparent analyses of all the available Liquidity Pools on major networks like Uniswap and SushiSwap, plus PlasmaFinance’s own native PlasmaSwap DEX. As you can see from the image above, this gives you a clear picture of all kinds of measurable data such as:

- Trading volume

- Pool size

- 7-d and 30-day Return on Investment (ROI)

- Fees

- Forecast of Impermanent Loss and Annual Percentage Yield (APY)

No need for you to manually comb through multiple platforms and calculate potential profits, every opportunity is happening in real time from this page, letting you identify the best yields as they unfold. And, as we covered in Lesson 1, you can even delve deeper into a Pool’s asset pairs, locating specific project information from its own Token Page.

Once you find a pool that you like and want to participate in, simply hover your mouse over the Pool and an option will appear for you to trade in the pool or to Provide Liquidity to it. This is the process, using the PlasmaSwap DEX as an example:

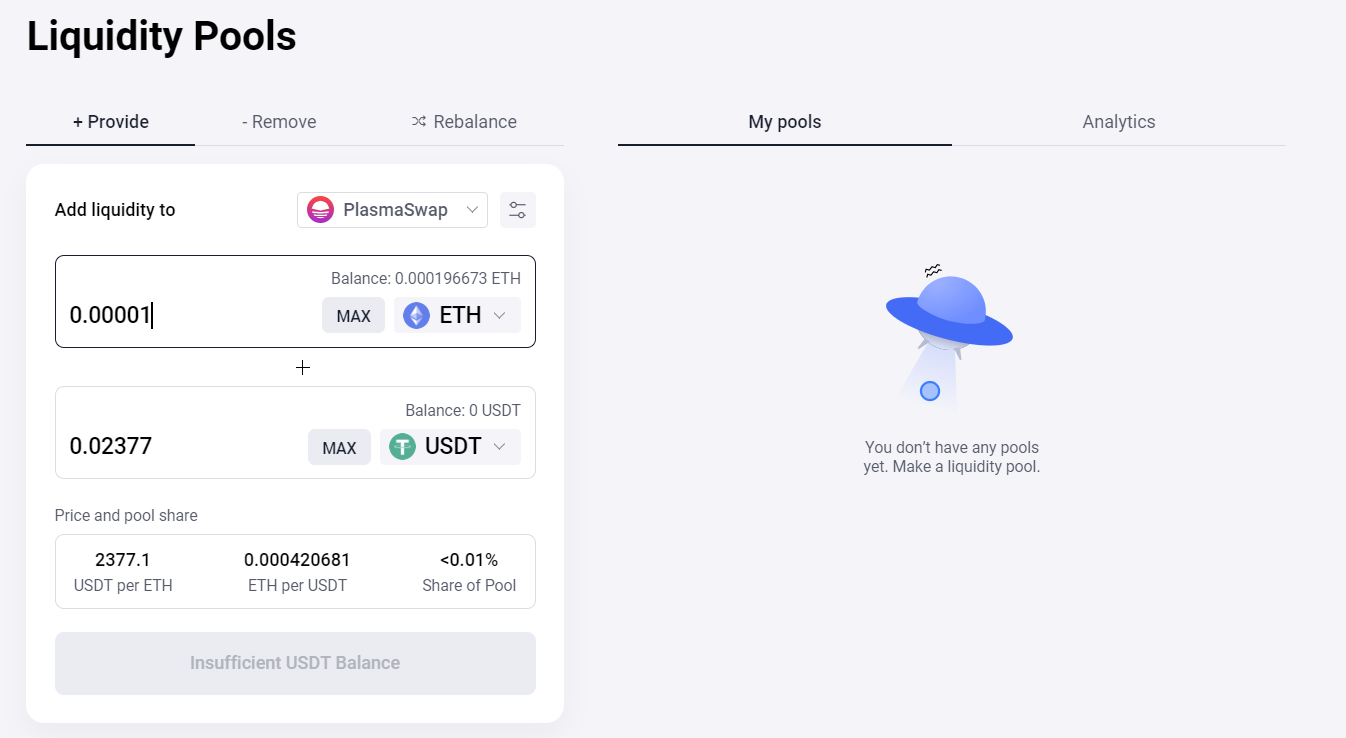

1. After connecting your wallet to a DEX, you visit the Liquidity page of the DEX. In this example, shown in the image above, it is on the “Liquidity Pools” page.

2. Locate the Liquidity Pool you want to participate in, say ETH-USDT. Hovering the cursor over any listed Pool brings up a “Manage Liquidity” button which is also on the page itself, as can be seen in the image above. Click on the button.

3. You should now see a screen that allows you to “add liquidity”. In the PlasmaSwap example above, you will see it under the “Provide” tab. Enter the amount of each asset you want to provide. Adjusting the amount of either asset should automatically adjust the amount of the other.

4. You then approve the interaction.

5. You then authorize the transaction.

6. When it is confirmed by the network, the smart contract executes:

- Your ETH and USDT is transferred into the Liquidity Pool.

- An amount of LP tokens, say ETH-USDT-LP, is transferred into your wallet. These LP tokens represent your share of the Liquidity Pool.

You can always redeem these LP tokens (usually with a small penalty if you do so too soon), you will receive back your proportional share of the Liquidity Pool PLUS your proportional share of all commissions/fees charged when others swap using that pool.

As an additional feature, PlasmaFinance also lets you CREATE your own liquidity pool if one doesn’t already exist! Simply visit the Manage Liquidity page, and select the token pairs you want to add in equal value, and confirm the transaction on your chosen DEX.

2. Staking: back a great DeFi product and share the profits

Today, the most popular DeFi platforms use their tokens as a way to further promote their platform, while giving additional ways for their supporters and users to earn further revenue. We’ll use the examples of DEX tokens here, like Uniswaps’s UNI, PancakeSwap’s CAKE, and PlasmaFinance’s PPAY tokens.

Each of these DEXs now allow their users to earn passive income from Staking (sometimes called Savings) their tokens into the platform. This actually gives the platform fixed and predictable liquidity into its own native pools, allowing them to serve higher volumes of trades. In return, token holders will earn a share of the platform’s revenue each time someone uses their products and services. Because of the passive nature of this investment, Staking is popular for non-active DeFi investors.

PlasmaFinance is building a vibrant, active community that together seeks to share in our vision of DeFi for all. Through holding and staking of our native PPAY token, anyone can own a share of PlasmaFinance’s successful future. Holding PPAY entitles you to:

- Earn passive income from staking PPAY into PlasmaFinance and earning a share of revenue every time someone uses our products and features.

- Qualify as an investor in upcoming exciting new projects that will launch tokens on our platform.

- A say in decision-making in upcoming governance measures so you can be a part of our future directions.

As PlasmaFinance’s already diverse range of products and services continue to expand, and more users come on board to experience easy and convenient DeFi, PPAY holders can expect to enjoy their share of growing revenue together.